Cynthia Erivo

Cynthia Erivo

Actress, Singer, Producer

Cynthia Erivo is a Grammy® Emmy® and Tony® Award-winning actress, singer and producer, author as a 3x Academy Award® nominee. She stars as Elphaba opposite Ariana Grande’s Glinda in Universal’s record-breaking film adaptations of the hit musical WICKED from director Jon M. Chu, WICKED and WICKED: FOR GOOD. WICKED Part One opened on November 22nd, 2024 at number one and has since become the highest grossing movie ever at the domestic box office based on a Broadway musical. Erivo has received widespread critical acclaim and rave reviews for her performance as Elphaba including Golden Globe, SAG, Critics’ Choice, NAACP, BAFTA, and Academy Award nominations. In November 2025, the follow up film WICKED: FOR GOOD opened at number one at the box office, exceeding expectations and breaking records including the biggest opening weekend for a Broadway adaptation. Erivo continues to receive widespread raves for her performance.

Erivo released her second studio album, I FORGIVE YOU, on June 6th, 2025 with Republic Records. She received a 2026 Grammy nomination for her single ‘Be Okay’ off the album in the category of ‘Best Arrangement, Instrumental or A Cappella’ and was also nominated for a 2026 Grammy Award in the category of ‘Best Pop Duo/Group Performance’ with Araina Grande for their version of ‘Defying Gravity’ from Universal’s WICKED. Erivo’s debut album, Ch. 1 Vs. 1 was released in September 2021 with Verve/Universal Music Group.

Erivo is a NEW YORK TIMES Bestselling author, having published her book Simply More: A Book for Anyone Who Has Been Told They’re Too Much via Flatiron Books, an imprint of Macmillan Publishers, on November 18, 2025. The book was an instant NEW YORK TIMES Bestseller, appearing #7 on the list in its debut week.

This winter, Erivo will make her highly-anticipated West End return in DRACULA. A one-woman show from the creative team behind The Picture of Dorian Gray. She will play 23 characters within the stage production – from the naïve solicitor Jonathan Harker and his fiancée Mina Murray to confidante Lucy Westenra, her suitors, and the formidable vampire hunter Van Helsing — as well as the infamous Count Dracula themself.

Recently, Erivo wrapped production for the film adaptation of the Broadway sensation, PRIMA FACIE. She also Executive Produced the film under her Edith’s Daughter banner. The story follows a British defense barrister who exudes enviable brilliance in navigating the ruthless and gladiatorial London courtrooms. Erivo also recently wrapped production on Paramount’s CHILDREN OF BLOOD AND BONE, where she will star alongside an incredible ensemble cast including Viola Davis, Chiwetel Ejiofor, Idris Elba, Amandla Stenberg, Damson Idris, Regina King, Lashana Lynch and more. She will also star in Lionsgate’s KAROSHI, a corporate thriller with a samurai twist alongside Teo Yoo and Isabel May.

In May of 2025, Erivo guest starred in the second season of Peacock’s critically acclaimed series, POKER FACE from creator Rian Johnson, where she starred opposite Natasha Lyonne. In her episode, Erivo conquers the challenging high-wire task of playing five different characters within the premiere episode of season two, which was released on May 8th, 2025. In 2025, she also voiced the character of The Slink in the animated Disney Jr. series ROBOGOBO, which earned her a Children’s and Family Emmy nomination in the category of “Best Single Role Voice Performer in a Children’s or Young Teen Program.”

In Spring 2024, Erivo starred in and produced DRIFT, which follows a young Liberian refugee named Jacqueline (Erivo) who has barely escaped her war-torn country to a Greek island. The film made its World Premiere at the Sundance Film Festival on January 22nd, 2023 and opened to rave reviews. It made its theatrical release on March 26, 2024. In addition to starring in and producing the film, Erivo also wrote and recorded original song, “It Would Be” for the film.

In 2021, Erivo was nominated for an Emmy® for her critically acclaimed portrayal of Aretha Franklin in National Geographic’s Emmy-winning global anthology series GENIUS: ARETHA. This season is the first-ever, definitive, and only authorized scripted limited series on the life of the universally acclaimed Queen of Soul. The series premiered on National Geographic on March 21, 2021.

In addition to her illustrious acting career, Erivo is a Grammy®-nominated songwriter and performer, often headlining sold-out shows, symphonies, and music spaces including the Kennedy Center Honors, the 2020 Academy Awards, the 2017 Governor’s Ball and the 2017 Grammy Awards.

Erivo released her first children’s book titled, Remember to Dream, Ebere on September 28, 2021. The book follows a young girl named Ebere whose mother encourages her to dream as big as possible. Erivo wrote the book as an ode to a child’s imagination, a parent’s love and the big dreams shared by both.

Erivo recently starred opposite Idris Elba in the Netflix feature film installment of Luther: The Fallen Sun, continuing the story of the acclaimed crime series. Erivo plays a detective who is also Luther’s nemesis while Serkis is the story’s criminal villain. Luther: The Fallen Sun premiered on Netflix on March 10, 2023.

In 2022, Cynthia Disney’s live-action retelling of PINOCCHIO. Directed by Robert Zemeckis, Erivo will take on the iconic role of the Blue Fairy. She is also slated to star in Apple’s ROAR, an anthology series of darkly comic feminist fables. It was also announced that Erivo will produce and star in a biopic about Sara Forbes Bonnetta, a 19th-century Nigerian princess who was “gifted” to Queen Victoria after being liberated from slavery.

In August 2020, Erivo launched her production company, Edith’s Daughter, and announced her first-look deal with MRC Television & Civic Center Media. Edith’s Daughter focuses on projects that express the beauty in the stories and people who are often overlooked and underrepresented. Erivo named Solome Williams as Vice President of the company.

Erivo starred in the HBO series THE OUTSIDER, which premiered on January 12, 2020. The series is based on the Stephen King novel of the same name. The series follows an unorthodox investigator and a seasoned cop investigating a gruesome murder of a local boy.

In 2019, Erivo starred in Kasi Lemmons’ HARRIET, where she brought the legacy of Harriet Tubman to the big screen. Focus Features released the film in theaters on November 1, 2019, and Erivo’s performance was met with critical acclaim. Additionally, Erivo lent her voice to the movie’s title song, “Stand Up,” for which she co-wrote. “Stand Up” won “Best Original Song” at the Hollywood Music in Media Awards. Both Cynthia and “Stand Up” were nominated for two Academy Awards as well as two Golden Globe Awards in the categories of “Best Actress in a Motion Picture – Drama” and “Best Original Song” respectively. Additionally, “Stand Up” received a nomination for a Grammy Award in the category of “Best Song Written for Visual Media.” The film also garnered ten NAACP nominations as well as AAFCA and Society of Composers & Lyricists Award wins.

Cynthia Erivo

Cynthia Erivo Ava DuVernay

Ava DuVernay

Ray Davis

Ray Davis Tetiana Anderson

Tetiana Anderson IN-Q

IN-Q Carey Arensberg

Carey Arensberg Jeff Fetters

Jeff Fetters

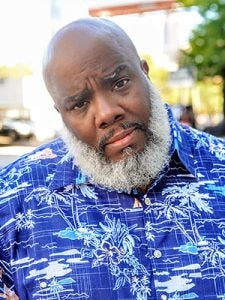

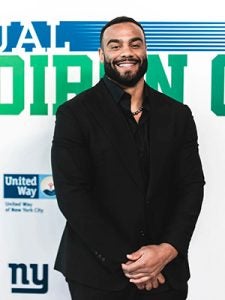

Rodney McLeod

Rodney McLeod Jennifer Frommer

Jennifer Frommer  Ariel Atkins

Ariel Atkins Demario Davis

Demario Davis Jeffery Simmons

Jeffery Simmons

Trymaine Lee

Trymaine Lee Osa Odighizuwa

Osa Odighizuwa