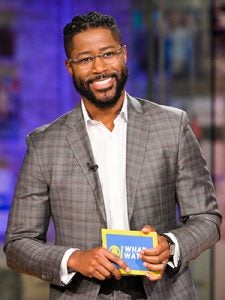

Kardea Brown

Emmy Nominated Food Network Host and Author, Host of “Delicious Miss Brown,” Former BBBS Staff

Kardea Brown is an Emmy Nominated contemporary Southern Chef born in Charleston, South Carolina, and host of the Food Network series, “Delicious Miss Brown,” now in its eighth season. Of Gullah Geechee descent, Kardea was raised by her single mother and grandmother and spent much of her childhood on Wadmalaw Island among the Gullah community where she grew up with the foods, flavors, history and heritage of her culture.

The Gullah community formed when West Africans arrived in the Lowcountry as slaves and they developed a cuisine born of necessity, making use of local ingredients harvested from land and sea. It was through her grandmother that Kardea learned of and tasted the traditional foods of her ancestry, learning to prepare many of the dishes she cooks today. While dedicated to preserving her culinary roots and sharing the history of her culture, over time Kardea also began to infuse newer flavors that reflect her innate flair for cooking and exploration of diverse influences.

After graduating from Atlanta’s Oglethorpe University, Kardea accepted a job at a child placement agency and cooking became her therapy to work through the emotional toll of social work. When that toll became too great, Kardea moved to Newark, NJ for a fresh start and accepted a position with Big Brothers Big Sisters. There she thrived with exposure to different cultures and people that left her energized for a new journey.

Bringing Gullah Cuisine From the Lowcountry to the TV Screen:

While working in Newark, a former boyfriend learned of a casting call and submitted a lively and engaging tape of Kardea cooking which ultimately came to the attention of a production company who created a pilot with her for a Cooking Channel show. The producers subsequently connected with Food Network executives who responded that they loved her energy and personality but felt that she could benefit from more experience. This feedback proved to be a revelation to Kardea, who realized that she had finally found her true passion and decided to move back home to South Carolina and the food, family and traditions that are such an important part of her identity. Although she hadn’t yet mapped out her next career steps, inspiration struck on the return trip home, and she decided to create the New Gullah Supper Club pop-up in 2015. Born of a GoFundMe campaign, this traveling dinner series showcased Kardea’s heritage, with a menu that paid homage to the dishes passed down through her family for generations executed with her own signature flair.

Over time, Kardea stayed in touch with Food Network, appearing on several shows, and by fall 2018 she had filmed a proof of concept for her current show, Delicious Miss Brown. The show premiered on Food Network in July 2019 and is now in its tenth season. Filmed at Kardea’s home in Charleston, SC, the show celebrates the rich history of her Gullah heritage and the diversity of its cuisine, showcasing her passion for cooking and culture, while sharing stories as she prepares food for dinner parties and events for family and friends. On Delicious Miss Brown, Kardea shows loyal viewers – whom she affectionately refers to as her ‘cousins’ – another side of Charleston, and that the Gullah people and their cuisine are still thriving on the Sea Islands. Her take on traditional Gullah cuisine is lighter and more vegetable-forward, and part of Kardea’s mission is to show that Southern cuisine is much more than just fried food. In April 2023, she was nominated for a Daytime Emmy Award for Outstanding Culinary Host for her performance in Delicious Miss Brown.

Kardea also hosts The Great Soul Food Cook-Off, a series produced by discovery+ and OWN that premiered in November 2021 on the streaming service. The first-ever soul food cooking competition, The Great Soul Food Cook-Off spotlights the traditions of Black chefs and Black food, and the contributions soul food has had on American cuisine.

Kardea is also the newest Cohost of Kids Baking Championship on Food Network. She has also appeared in a range of other Food Network shows including Beat Bobby Flay, Chopped, Chopped Junior, Cooks vs. Cons, BBQ Blitz, Family Food Showdown, Cupcake Championship, Farmhouse Rules, Holiday Wars and Spring Baking Championship as a resident Judge.

From the Screen to the Page:

Kardea shares her multi-generational “passed down” recipes and innovative takes on Gullah classics with home cook in her cookbook The Way Home. “Gullah” and “GeeChee” refer to a distinct group of African Americans living in the coastal areas of South Carolina and Georgia who have preserved much of their West African language, culture, and cuisine. The Way Home is an unabashed love letter to her family’s roots, packed with dishes that combine West African herbs, spices, and grains with traditional Southern cooking. “Gullah people laid the foundation for Southern cooking. Before farm-to-table was a fad, it was what Gullah people did,” Kardea explains. “I want to show the world that soul food is not monolithic. It’s so much more than fried chicken and vegetables cooked in pork. It’s seasonal, fresh and delicious!”

Flavoring her recipes with cherished family anecdotes, memories, and helpful tips, The Way Home is a perfect blend of the modern and the traditional. Kardea honors her proud heritage and shows off her own signature class and sass. The result is a marvelous, big-hearted collection of recipes and stories that will nourish you, body and soul. The Way Home became an instant New York Times Bestselling Cookbook, making it to number 6 on the list.

Ray Davis

Ray Davis IN-Q

IN-Q Carey Arensberg

Carey Arensberg Jeff Fetters

Jeff Fetters

Rodney McLeod

Rodney McLeod Tetiana Anderson

Tetiana Anderson Jennifer Frommer

Jennifer Frommer  Ariel Atkins

Ariel Atkins Demario Davis

Demario Davis Jeffery Simmons

Jeffery Simmons

Trymaine Lee

Trymaine Lee Osa Odighizuwa

Osa Odighizuwa