Gifts through Your Will

A will is the cornerstone of any estate plan, no matter your income level. Benefits to giving through your estate plan include the following:

- You retain control of your assets during your lifetime – you can modify your bequest as circumstances change

- You can take advantage of tax laws that lower the estate tax burden on your survivors

- You can make a larger impact through a larger gift than may have been possible in your lifetime

You can add BBBSA to your existing will by revising and re-executing the document at any time, or by executing a separate amendment called a codicil.

There are multiple ways to make a gift through your will:

- Percentage

A bequest stated as a percentage will automatically adjust regardless of future circumstances. For example, "I leave 5% of my estate to BBBSA." - Fixed dollar amount

Your estate doesn't have to have cash or securities to cover the gift amount, as long as the value of all of your assets is sufficient. For example, "I leave $25,000 to BBBSA." - What is left of your estate after specific bequests have been made:

This ensures that your gift is made only after you know the assets won't be needed by your spouse or partner. For example, "If my partner survives me, then I leave my entire estate to my partner. If my partner does not survive me, then I leave my estate as follows…" When two partners use this clause in conjunction with each other, then each receives the other's assets upon the death of the first-to-die, and other heirs and organizations receive the remaining assets upon the death of the second-to-die.

Tax Language for Will

To make a bequest that qualifies for a federal estate tax charitable deduction, you may direct your gift to Big Brothers Big Sisters of America as follows.

I hereby give, devise, and bequeath (insert dollar amount or percentage of the residue/ all of the residue of my estate) to Big Brothers Big Sisters of America, a non-profit organization located at 2502 N. Rocky Point Drive, Suite 550, Tampa, Florida, 33607. Federal Tax ID #23-1365190, for Big Brothers Big Sisters of America’s general use and purpose.

Tax Note: A federal estate tax charitable deduction is usually not relevant for the many people whose estates are worth under $5,490,000 (or under $10,980,000 for a married couple). Those estates generally fall under the federal estate tax exemption. You should consult your own qualified financial and legal advisors to learn how the laws apply in your situation.

BBBSA’s Tax ID Number is 23-1365190. Big Brothers Big Sisters of America will honor all requests of anonymity.

Please contact us at (813)720-8778 or at donations@bbbsa.org if you have a question regarding your planned gift.

* Legal Notice: This information is not intended as tax or legal advice. For more information about estate planning and making a planned gift to Big Brothers Big Sisters of America, we encourage you to consult with your legal and financial advisors. Laws and regulations governing all gifts and availability of certain life income gifts vary by state.

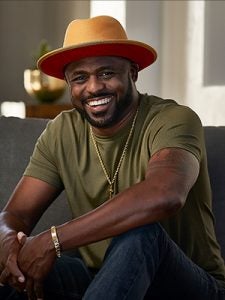

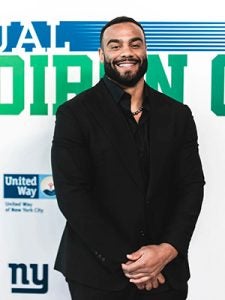

Ray Davis

Ray Davis IN-Q

IN-Q Carey Arensberg

Carey Arensberg Jeff Fetters

Jeff Fetters

Rodney McLeod

Rodney McLeod Tetiana Anderson

Tetiana Anderson Jennifer Frommer

Jennifer Frommer  Ariel Atkins

Ariel Atkins Demario Davis

Demario Davis Jeffery Simmons

Jeffery Simmons

Trymaine Lee

Trymaine Lee Osa Odighizuwa

Osa Odighizuwa