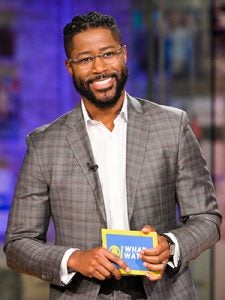

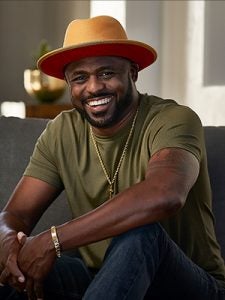

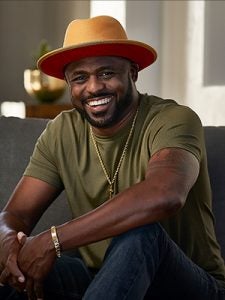

Wayne Brady

Emmy Award-winning Actor, Producer, TV Personality

Alumni Big

Multiple Emmy Award-winning and Grammy Award-nominated Wayne Brady has made his mark on stage and screen as an actor, producer, singer, dancer, songwriter, and television personality.

A true multi-hyphenate, Brady’s career path and personal life journey have helped him see the world in a unique way. His aspirations have always gone beyond solely starring in various entertainment projects, and under his A Wayne & Mandie Creative banner. He’s set out to create new content across different platforms that showcase innovation and inclusivity in fun and powerful ways.

A five-time Emmy winner (the first to win Daytime and Primetime awards in two consecutive years), Brady has an impressive TV resume including Whose Line Is It Anyway?, The Masked Singer, Dancing With The Stars, Black Lightning, The Good Fight, and Showtime’s American Gigolo– each spotlighting different aspects of his immense talent.

In February 2024, Brady will star in an upcoming Hulu docuseries following his blended family, alongside his ex-wife, best friend and business partner Mandie Taketa, their 20-year-old daughter Maile, and Mandie’s partner Jason. The series is produced by Wayne and Mandie’s joint production company, A Wayne and Mandie Creative, along with Fremantle.

In addition to being a force in front of the camera, Brady is heavily active behind the scenes wearing the hats of host & executive producer for Let’s Make A Deal, Game of Talents, and Comedy IQ, which he also co-created through his production company. All of this follows on the heels of the success of his award-winning daytime talk show The Wayne Brady Show.

Long an accomplished singer and performer, Brady’s musical acumen has always been a personal passion and he used that as fuel to help win the second season of The Masked Singer. Off his victory, Brady dropped a brand-new original single, entitled “Flirtin’ w/ Forever,” which quickly climbed the streaming charts, as well as an accompanying music video.

This follows the success of his debut album which was headlined by a version of Sam Cooke’s “A Change is Gonna Come” which earned him a Grammy Award nomination in the Best Traditional R&B Vocal Performance category.

Spring of 2024 Brady returns to Broadway in the all-new production of The Wiz, leading the cast as the titular character. The highly-anticipated musical features award-winning creatives and producers including Common, MC Lyte, Amber Ruffin, Hannah Beachler, Sharen Davis, among others.

Brady made his Broadway debut starring as legal showman ‘Billy Flynn’ in the long-running hit musical, Chicago. Soon after Brady starred as the ground-breaking character ‘Lola’ in Kinky Boots, Broadway’s Tony Award-winning Best Musical, with music and lyrics by Cyndi Lauper and a book by Harvey Fierstein. Brady would later headline as ‘Aaron Burr’ in the Chicago production of Lin-Manuel Miranda’s Tony Award-winning juggernaut Hamilton.

Brady again joined forces with Lin-Manuel Miranda, and the duo along with Thomas Kail and Anthony Veneziale, created Freestyle Love Supreme. The unique show combined the fusion of hip hop, improv, and comedy which won a special Tony Award for its innovation and contributions to the world of theater. The Freestyle Love Supreme team partnered with San Francisco improv company Speechless, Inc to create “freestyle+,” an educational training platform committed to making improv globally accessible.

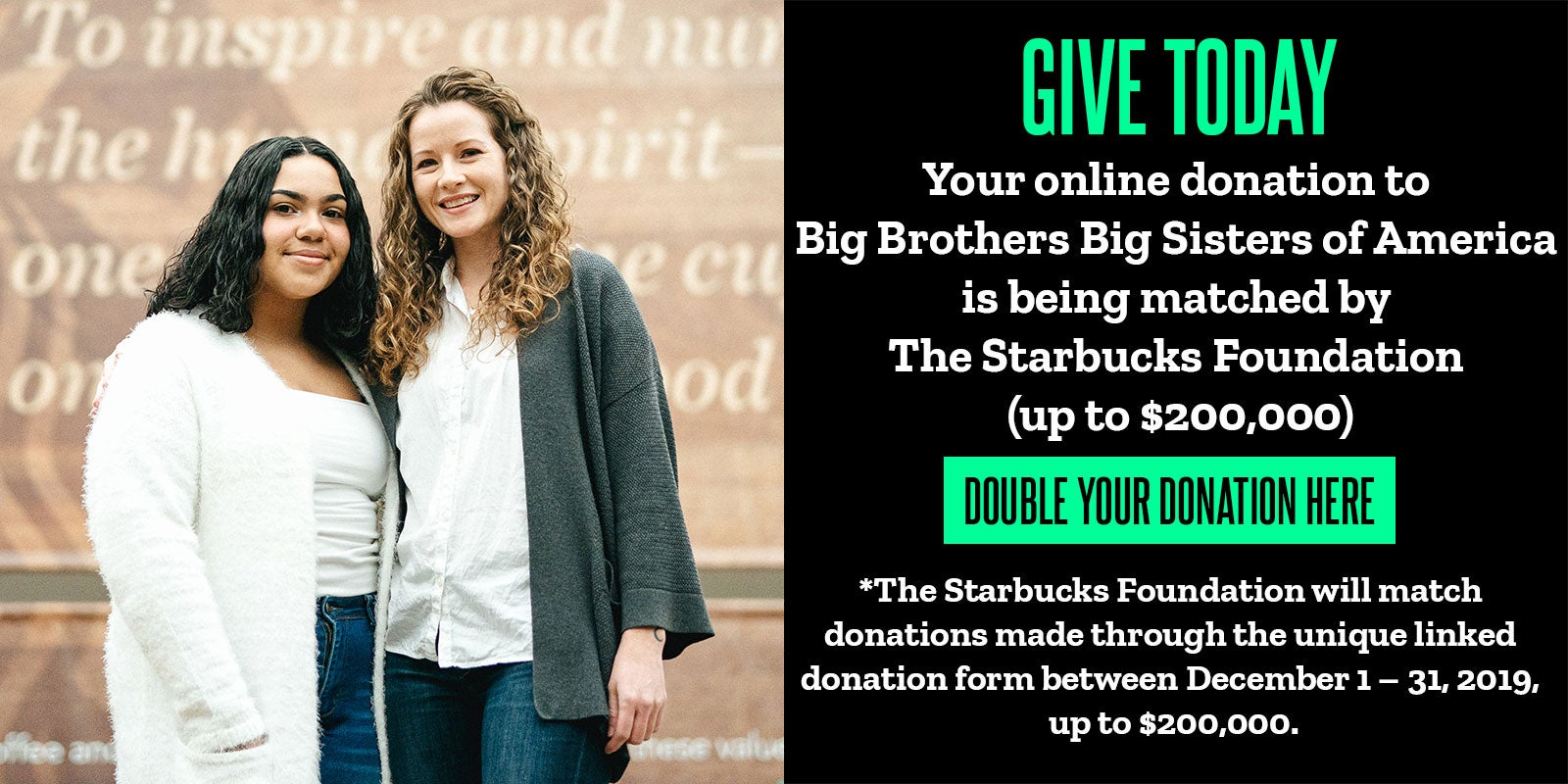

Advocacy is core to Brady’s life. He champions the need for more resources and better understanding of mental health issues, especially in the Black community. Brady’s public announcement about his pansexuality brings awareness to an underrepresented community and he continues to support and promote LGBTQIA+ causes and organizations such as Broadway Backwards and Gay Men’s Chorus of Los Angeles. Brady is a longtime supporter of the Big Brothers Big Sisters of America, Alzheimer’s Foundation of America and SAY The Stuttering Association for the Young.

Brady currently resides in Los Angeles.